Could “cash equivalent” be our catchcry?

The threats of surveillance capitalism and totalitarian governance bolster the need for a digital equivalent to cash.

We are fast approaching a ‘cashless society’ as governments and corporations continue waging war on cash. The push to digital promises lower business costs, fraud risk mitigation, and a reduction in criminal activities, but without a cash equivalent, everyone’s new banker will be Big Brother himself.

These centralized merchant solutions are back in the spotlight amidst the COVID-19 global pandemic. Many businesses are heeding health advice to accept only contactless payments. The US government has even proposed a $2.5 trillion coronavirus stimulus bill accompanied by a proposal for a digital dollar. An economic collapse would likely accelerate physical cash’s imminent demise into a digital dystopia.

What consumers will of course be expected to overlook, in favour of convenience, are widespread privacy concerns. Imagine having to ask a third party you don’t trust for permission to spend your own money, all the while succumbing to intrusive corporate and governmental surveillance. Such an infringement on your human rights would essentially require you to part ways with your personal autonomy.

That’s precisely what your role in a cashless society entails, opening the door to a long list of exploitative practices. The threats of surveillance capitalism and totalitarian governance bolster the need for a digital equivalent to cash.

There’s already so much uncertainty surrounding the world’s financial future. So before venturing into the unknown, let’s get one thing straight: Do people even care for cash?

People do care for cash, a lot.

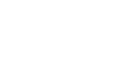

Globally, over $18 trillion a year still changes hands as physical cash and checks. Contrary to the benefits of digital convenience, cash payments are in fact increasing.

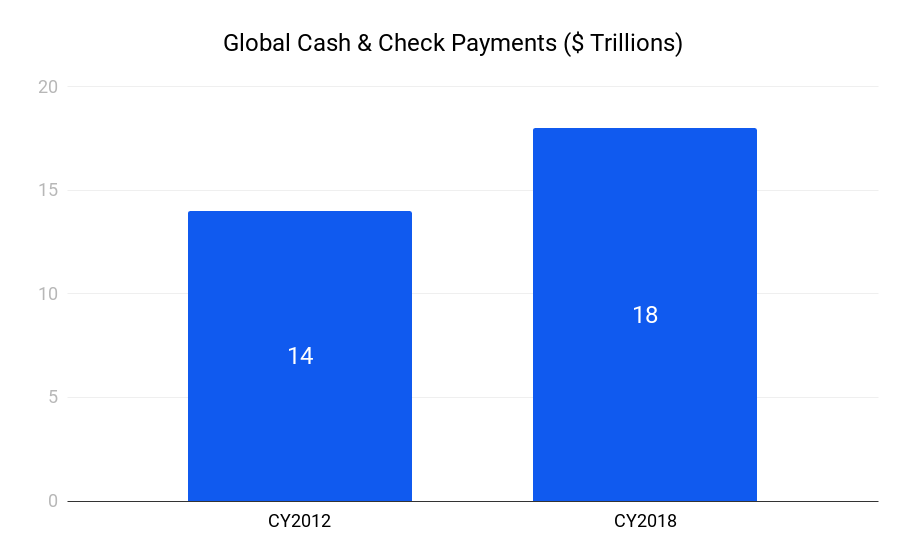

In the United States 37% of people choose cash as their favorite payment method. Digitizing the dollar represents a $4 trillion opportunity in North America, equating to over $90 billion in annual revenue from card processing fees alone.

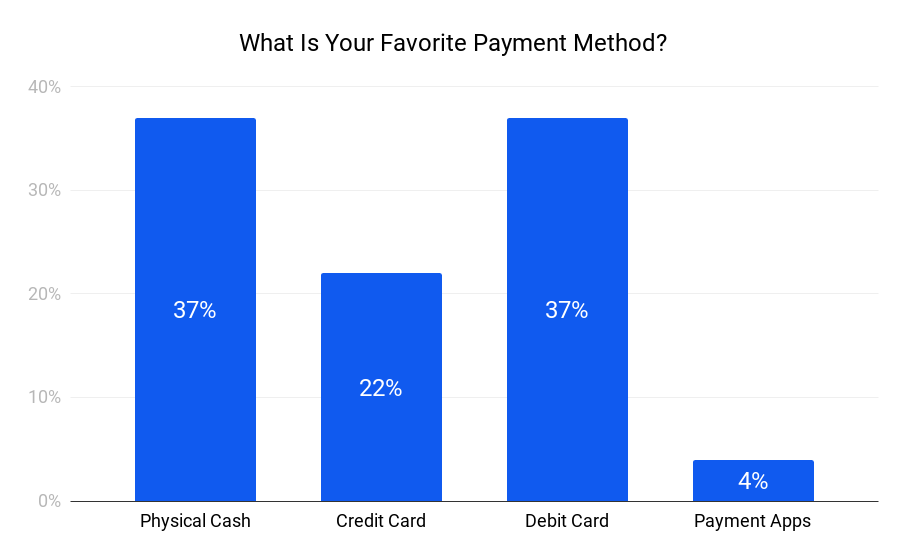

Although Americans are quick to adopt modern tech, almost half of the United States doesn’t use any payment apps. Those who do, shy away from credit and tend toward the convenience of centralized services, which allow them to spend their own dollars.

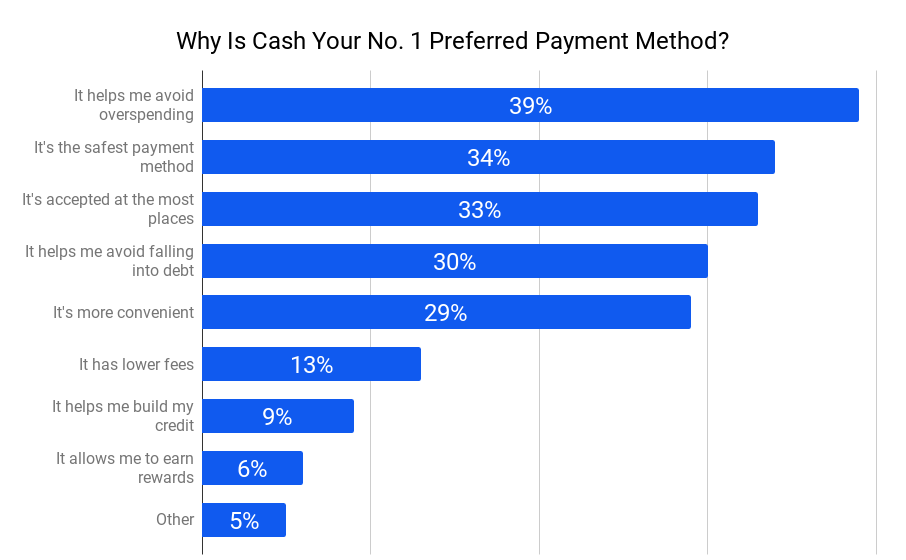

The cryptocurrency community preaches mostly ‘anti-surveillance’ sentiment. Yet those who choose cash do so for reasons of safety, budgeting, and acceptance. What if “cash is king” among consumers is because its denominations make it better suited to penny-pinching?

Properties unique to cash also appear to be what resonates most with its proponents. Privacy on the other hand, isn’t high on the list of consumer priorities. It is essential to cash’s function, for assurance of fungibilty, so that every dollar is interchangeable for another. Demand is high, so when supply dries up, consumers will likely look for a cash alternative that still solves their problems.

Creating a cash-equivalent cryptocurrency

Part of my role at the Veil Project has been defining our vision, mission, and values. Since people choose convenience over privacy, I knew that we’d have to focus on more than just privacy itself. While privacy is, and always will be, core to everything we do, it’s not our only priority.

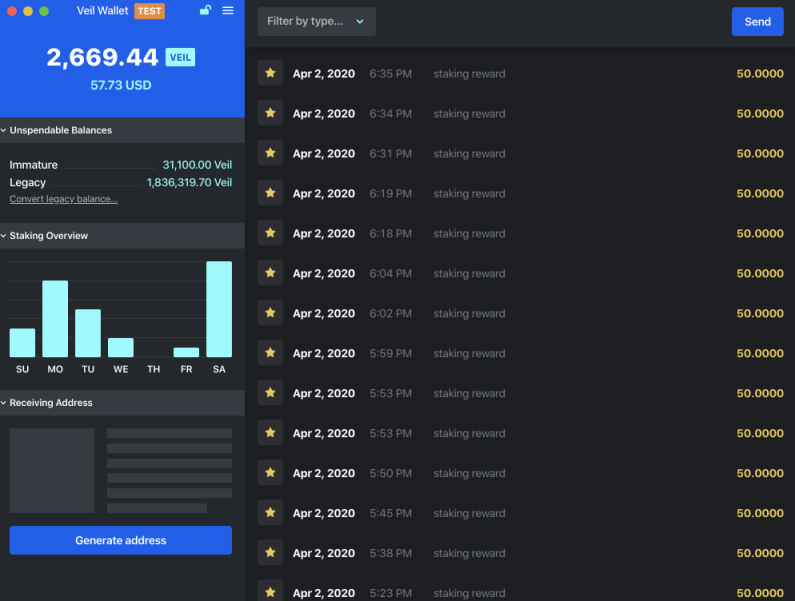

Who would have thought when we rolled out our 2020 vision that it would be up for review so soon? And yet, as outlined on our executive summary website, we’re staying the course. I’m proud to say we are creating a cash equivalent and the necessary components for it to thrive.

Cash is sought after by shadow economies because it’s unlikely to be tainted, doesn’t require permission from, or trust in a third party, and comes surveillance-free as standard. Although for consumers in the clear, direct settlement, availability, tangibility, budgetary denominations, broad acceptance, and avoidance of debt and fees, make it the crowd favorite.

A fundamental truth for cash as we know it, is that my dollar is as good as yours. When cash is taken from us, would you bet your Benjamin’s that demand outweighs supply, and an equivalent will prevail? Here at Veil Project we would because in a cashless society we think convenience and privacy will be the same thing: an open, secure, and decentralized surveillance-free digital economy.

While privacy is, and always will be, core to everything we do, it’s not our only priority. Our main priority is you, because when all is said and done, it’s you who will help us cross the chasm. Testament to our unwavering commitment to users, Veil X is the culmination of everything we’ve learned, and everything we will continue to learn, about those searching for a digital cash equivalent.

Want to be notified the moment Veil X is released to our community, become an early adopter, and share your experiences with cashless societies?